Contents:

One such QuickBooks error that is commonly reported by the users is software unable to open company file in QuickBooks … From the list, select the account you wish to reimburse the amount to. Personal finance is a popular niche for software-as-a-service , so Quicken has seen the rise of many competitors over the past 10 years.

Further, a reminder can be set within the software in order to stay on top of expenses. If you do not want to deal with multiple company files, then at the least you should create a separate account for managing personal expenses within the business expense company file. A new expense account can be create via the chart of accounts window.

If you are using QuickBooks to track personal expenses, then the most likely category is ‘Personal Expenses’. This category includes expenses such as groceries, entertainment, and clothing. Using QuickBooks to manage your personal finances essentially empowers you to take decisions backed by data and smart insights. Managing personal finances with a business tool, like QuickBooks, allows you to leverage powerful features.

Please check with an attorney or financial advisor to obtain advice with respect to the content of this article. All the transactions which were previously mistakenly excluded are now “un-excluded”, and back in the Banking Center. Gentle Frog is an independent bookkeeping company, we are not affiliated with Intuit QuickBooks or any bank. Learn how to record and asset purchased with a loan in QuickBooks Online.

Easy Process

Most often you’ll see these get coded as Distributions, which again is not wrong, but it’s not bulletproof. When you show it as a loan, and then restatement of retained earnings it, that’s consistent with the story that it was a mistake, and we do care very much about running our business properly. Note this is an expense using the Expense report account , and we’re using the Item Details section to capture inventory. In other words, you could lose the benefit of the very protection of personal assets that having a corporation affords. Whether you choose to do a daily, weekly or bi-weekly reconciliation, the process is the same.

QuickBooks is a popular cloud-based accounting software used by businesses of all sizes. You can enter past transactions as well as future transactions, which means you can also forecast your future months spending more easily if you know payments are due to made soon. Perhaps one of the best benefits of using QuickBooks for your personal finances is the ability it gives you to stay in control of your cash flow.

- Therefore there are a few things wrong with mixing personal and business in one bank account.

- Of course, small business owners want to be careful not to include any personal expenses in business deductions.

- However, business owners often pay for business expenses personally and it is quite easy to account for business expenses that are paid personally.

- Later, when viewing transactions in the Banking Center, they may identify those transactions as personal expenses and choose to exclude them, instead of adding them to QBO.

- Essentially, QuickBooks can capture and organise all your expenses.

QuickBooks is an accounting software package designed for small- and medium-sized businesses, and it is one the most widely used in business worldwide. I work for a company who is an LLC operating for tax purposes as an S Corp. The Single Owner Shareholder loves to mix his money, creditcards, etc through the company books. Actually I think all of his familys personal expenses hit the Quickbooks Desktop Pro application at some point each month.

With this system you avoid the need to enter each personal transaction into QuickBooks . The disadvantage is that you may always seem to have the «wrong» checkbook along with you when you want to make a purchase. After setting up your chart of accounts, open the Profit & Loss report.

QuickBooks for personal use

Also legally if the money in the bank account is owned by corp, then you shouldn’t be using it for personal expenses, as it’s not your money. It’s probably not illegal, but the IRS may decide it’s income, and it will be subject to income tax and 15.3% self employment tax. You should be on the payroll of the corporation, and drawing a reasonable salary, and paying withholding taxes, while the corp pays employer tax. You have to declare assets on the tax return, so you definitely should not exclude any transactions.

Tracking income and expenses- QuickBooks for Personal Finance Keeps a record of income and expenditure which is easily accessible to the user at any time. As accounting software, QuickBooks enables you to record expenses with sheer ease. Properly recording operating costs is essential, especially costs like employee wages, factory leases, supplier costs, and depreciation. Follow the same procedure as you would categorize any other expense by choosing to create a new category for Owner’s Draw and then categorizing the expense accordingly.

Tired of manually categorizing expenses? See how Ramp can automate this for you in the demo below

Consider the situation where you pay yourself a monthly «salary» by transferring $10k from your business checking to your personal checking. If you’re using two company files, this transaction is an expense on the business side and income on the personal side. But if you are using a single company file, the transaction is just a transfer between bank accounts, so it won’t show up unless we make a small change to the usual transaction. Here’s how to get the salary to show up using QuickBooks Online. I am a sole proprietor who works full time for an employer and who also has a side bakery/hobby business. Because of this, I use my personal checking accounts for purchasing materials and supplies as well as receiving payments for cakes.

FreshBooks vs. QuickBooks Comparison – Forbes Advisor – Forbes

FreshBooks vs. QuickBooks Comparison – Forbes Advisor.

Posted: Tue, 28 Mar 2023 07:00:00 GMT [source]

Freshbooks has fair and affordable pricing plans, which means that it can be available to any user, who wishes to take their financial tracking process to the next level and avoid mismanagement of funds. This user friendly software, involves the inclusion of features in an extensive way that which is hailed by many quarters, who include customers and the clients. This also makes a client’s work easier, by having them clear bills for example paying the nanny, plumber and gardener among others, and in the process keeping financial reports for future reference. This can customers hone their management skills from the comfort of their house, which can be transferred to running businesses. One option is keep a separate personal checking account, use it for all personal spending, and replenish it with funds from farm checking account as needed.

It is crucial to understand such structures and the tax and legal complications of every future growth of your business. ➤ Then go to the Journal entry and choose the Plus icon on the top. Hyper-accurate, up-to-date books that close on time, every time—without the effort. Access the funds you need to scale and the tools to deploy them effectively. These reports will help you plan budgets more efficiently and also help you draw insights about your home finances.

If you don’t agree with the suggested category, use the drop-down menus to select the correct category before you complete the entry. A controller is an individual who has responsibility for all accounting-related activities within a company including managerial accounting and finance. Cash concentration and disbursement is a type of electronic transfer, often used to transfer funds among remote locations and so-called concentration (i.e. collection) accounts.

QuickBooks Survey: Black-Owned Businesses Continue To Face … – eSeller365

QuickBooks Survey: Black-Owned Businesses Continue To Face ….

Posted: Wed, 01 Feb 2023 08:00:00 GMT [source]

You must always reimburse the company for any personal expense if you want to avoid legal troubles. QuickBooks allows you to access almost all types of accounts, including but not limited to savings account, checking account, credit card accounts, and money market accounts. Of course, small business owners want to be careful not to include any personal expenses in business deductions. And misclassifying these transactions in QuickBooks, other than an Owner’s Draw or Loan to Shareholder, can have negative tax implications. Yes, QuickBooks can help you keep track of your personal finances; just like it helps businesses organise their finances.

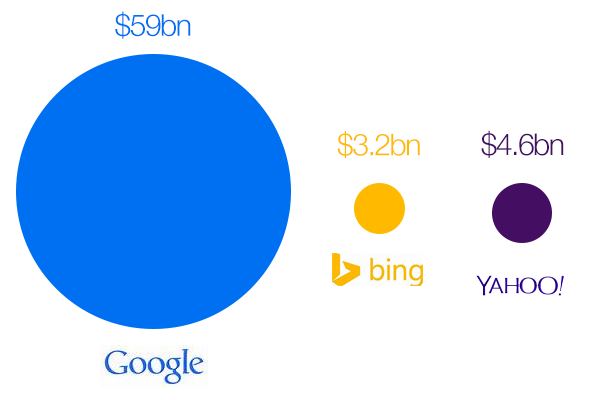

True alternatives will provide the ability to manage a business’s accounting books, send payments, create and send invoices, collect payments, and budget. Some of the most popular alternatives to QuickBooks include Xero, FreshBooks, Sage, Zoho, and Wave. That feature set is not a complete list of what QuickBooks can do.

- With the help of this software, you can import, export, as well as erase lists and transactions from the Company files.

- Perhaps one of the best benefits of using QuickBooks for your personal finances is the ability it gives you to stay in control of your cash flow.

- Investopedia requires writers to use primary sources to support their work.

- Leveraging QuickBooks’ features to manage household finances will help you get personal insights that are just impossible to get from simple notes or spreadsheets.

- I have only started but have been doing a mixture of both methods and want to do what is best going forward.

Apart from simply managing business and personal expenses, you can do a lot more with QuickBooks. The vast array of features available in this accounting software will blow your mind. Not only can you manage the expenses that have already happened, but can also manage both accounts payables and accounts receivables.

Create «memorized transactions» with QuickBooks to keep track of recurring payments easily. Quickbooks will automatically create an entry every week/month/year. You’ll simply need to update the amount for the transaction and pay.

For individuals , AMS can help keep track of every aspect of their financial life. Read on to find what each of these two tools in particular offers a user and figure out which may be right for you. Dancing Numbers is SaaS-based software that is easy to integrate with any QuickBooks account. With the help of this software, you can import, export, as well as erase lists and transactions from the Company files.

Both methods are equally easy to record expenses, especially personal ones. When you are capturing and recording expenses in QuickBooks, it’s important to remember that your personal and business expenses need to be separated. What QuickBooks offers for the small business, Quicken offers for individuals and families. Quicken tracks your account balances, transactions, investments, personal budgeting, loans, and any other part of your personal financial life. The Home & Business version includes the ability to track rental properties and small businesses in addition to your personal information. QuickBooks also offers both a desktop version for a fixed fee and an online version accessible through your web browser, tablet, or smartphone for a monthly or yearly subscription.